- Published on

How to Apply for a Tax Refund Early in New Zealand?

- Authors

- Name

- irisjustdoit

- @irisjustdoit

Many friends may forget about tax refunds after finishing their working holiday in New Zealand or think they have to wait until April to get their tax back, but you can apply for a refund early!

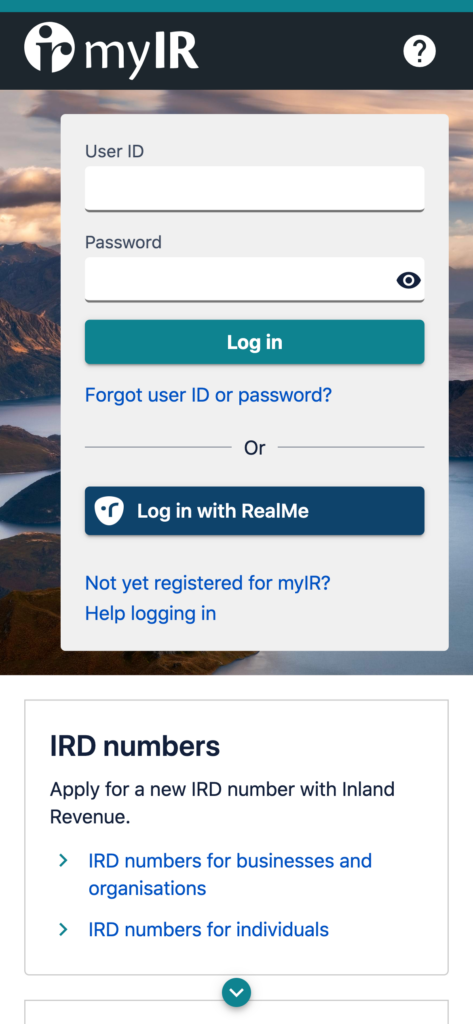

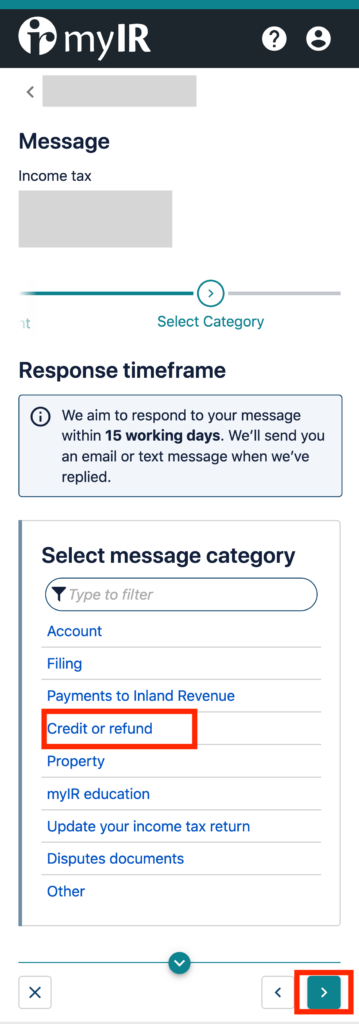

- First, log in to MyIRD

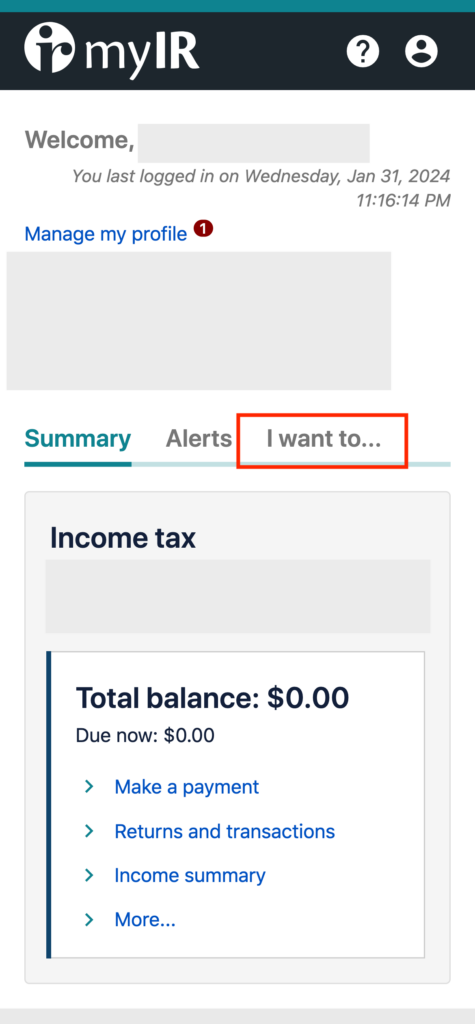

- After logging in, click on "I want to"

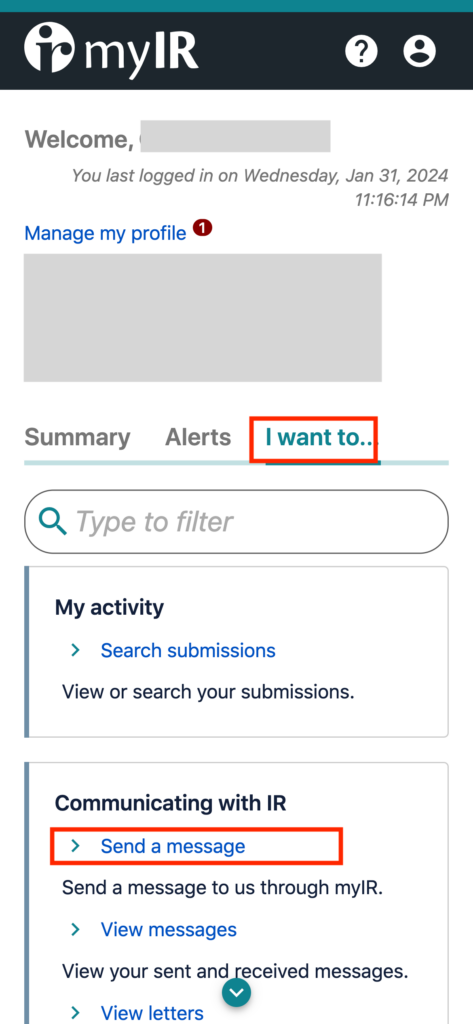

- Click on "send a message"

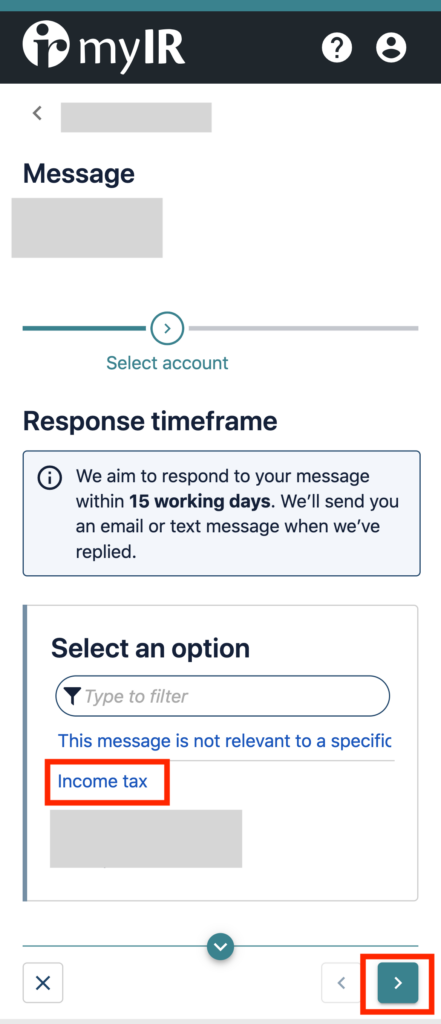

- Click on "income tax"

- Click on "credit and refund"

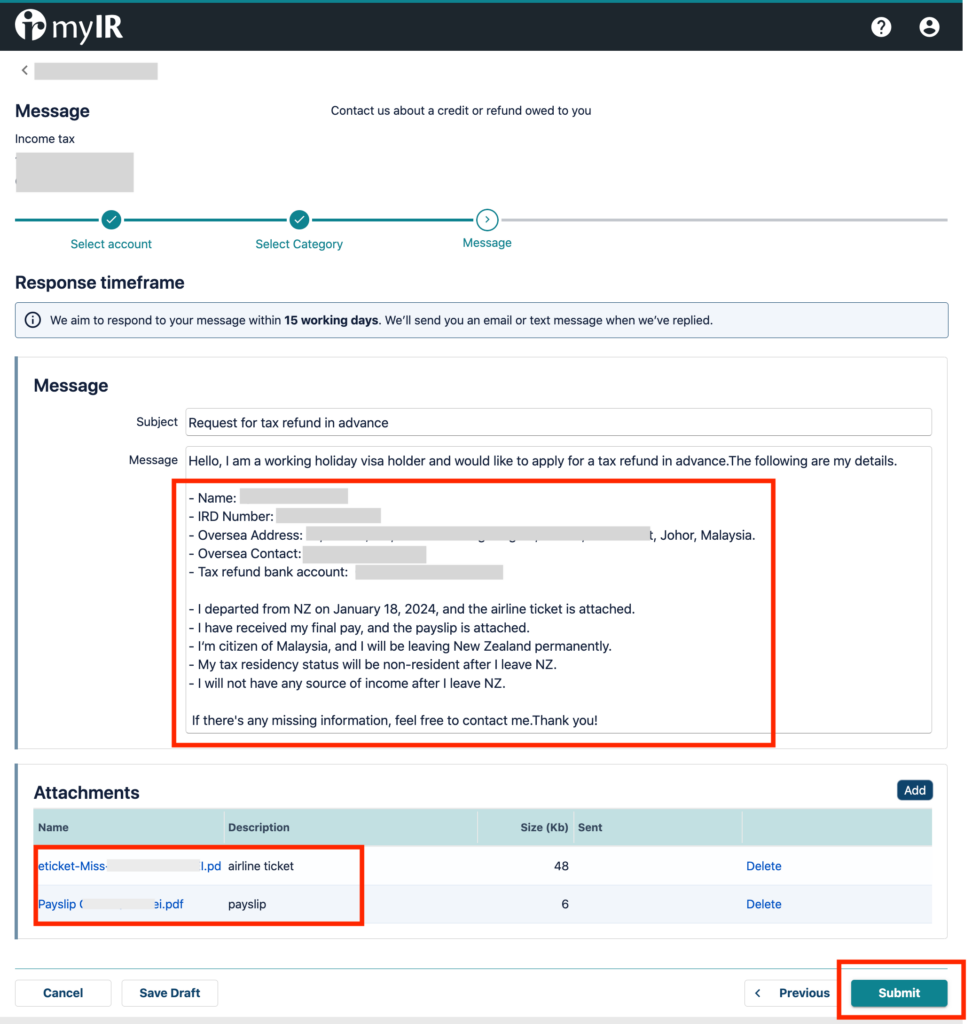

- Enter the message information. This should provide the most complete information. Each statement must be written, and provide proof of your flight and the last payslip.

Title: Request for tax refund in advance

Hello, I am a working holiday visa holder and would like to apply for a tax refund in advance. The following are my details.

- Name: xxx

- IRD Number: 000-000-000

- Overseas Address: xxx

- Overseas Contact: +60xxxxxxx

- Tax refund bank account: xx-xxxx-xxxxxxx-xx

- I departed from NZ on January 18, 2024, and the airline ticket is attached.

- I have received my final pay, and the payslip is attached.

- I'm a citizen of Malaysia, and I will be leaving New Zealand permanently.

- My tax residency status will be non-resident after I leave NZ.

- I will not have any source of income after I leave NZ.

If there's any missing information, feel free to contact me. Thank you!

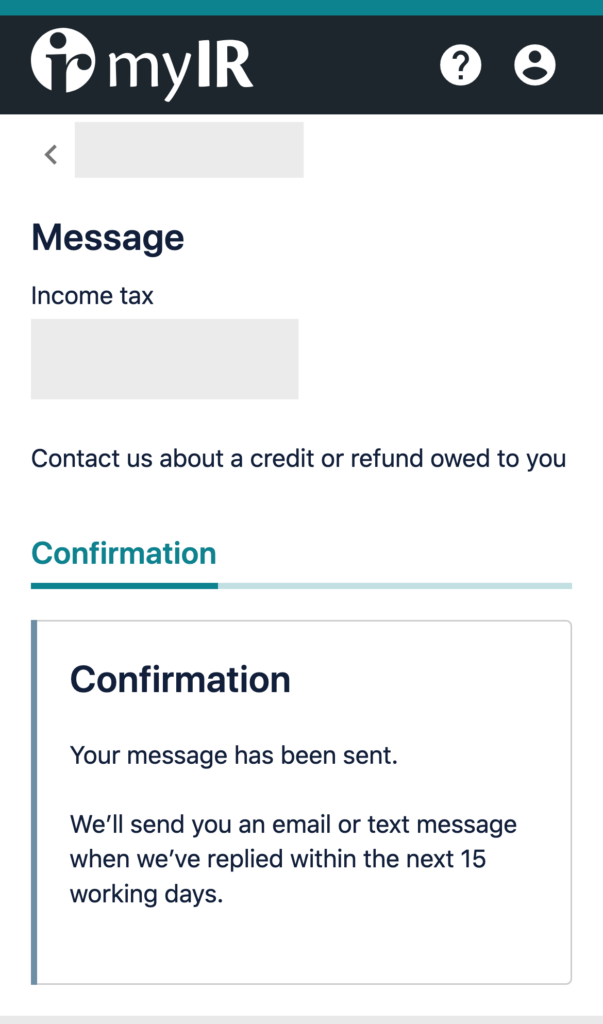

- After submitting, just wait for a response.

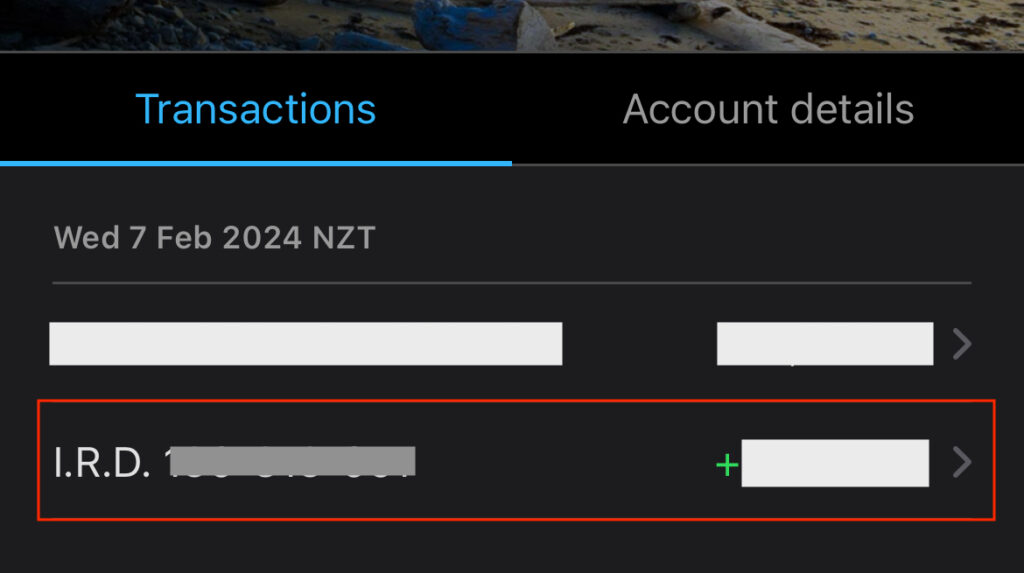

- You don't have to wait 15 days; I received a message the next day, and the refund was completed within two days.

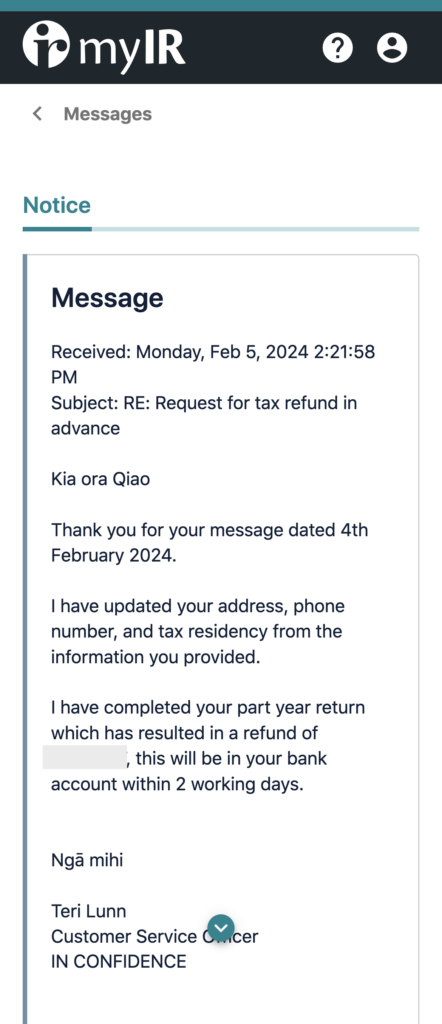

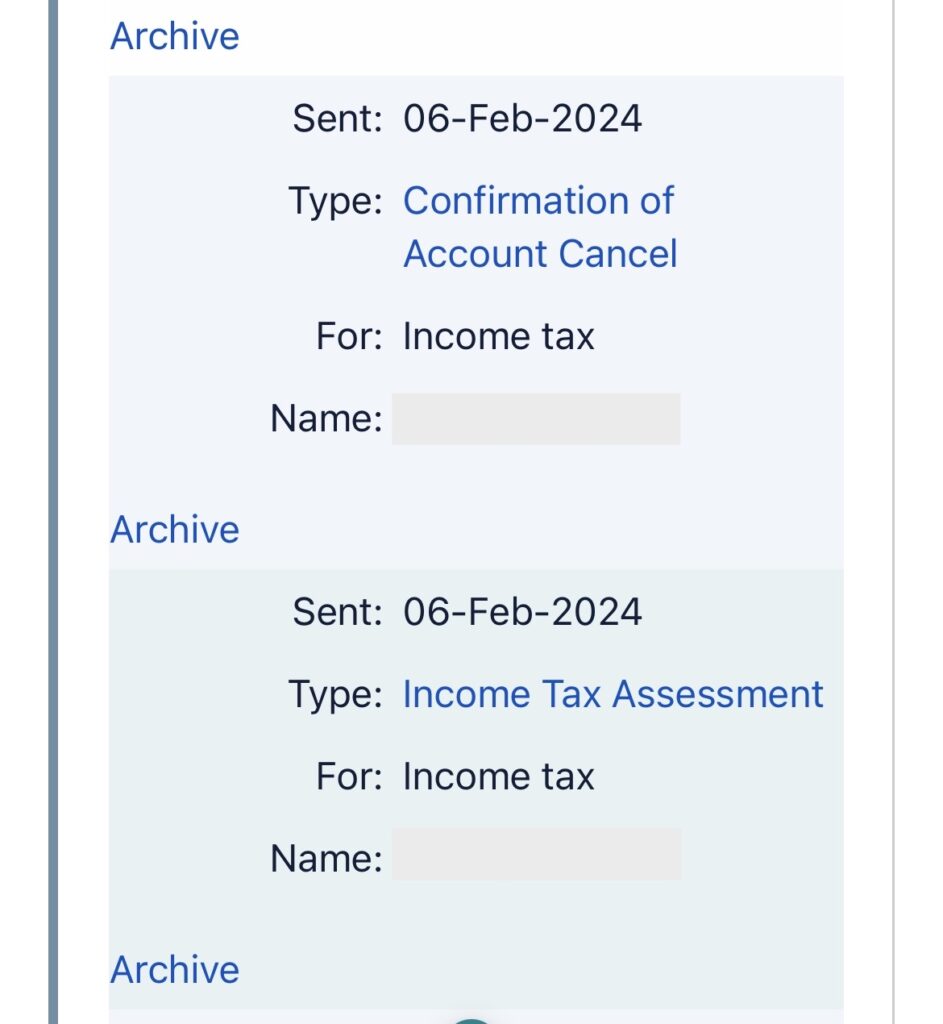

- The next day, I received two letters

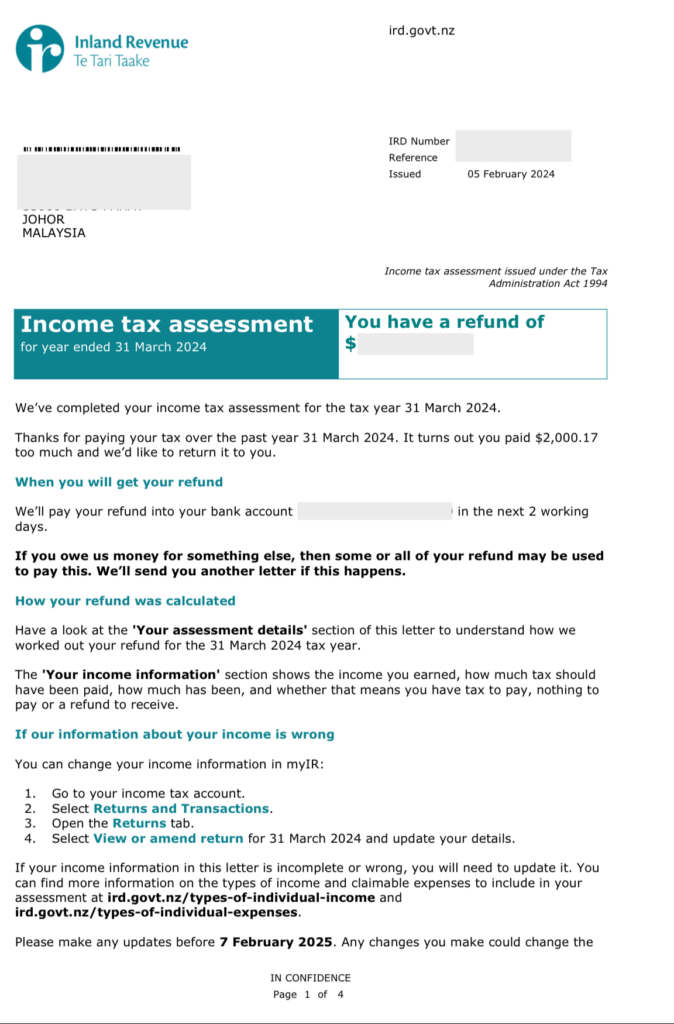

- The first letter is the tax refund estimate, which shows the total income and final refund amount.

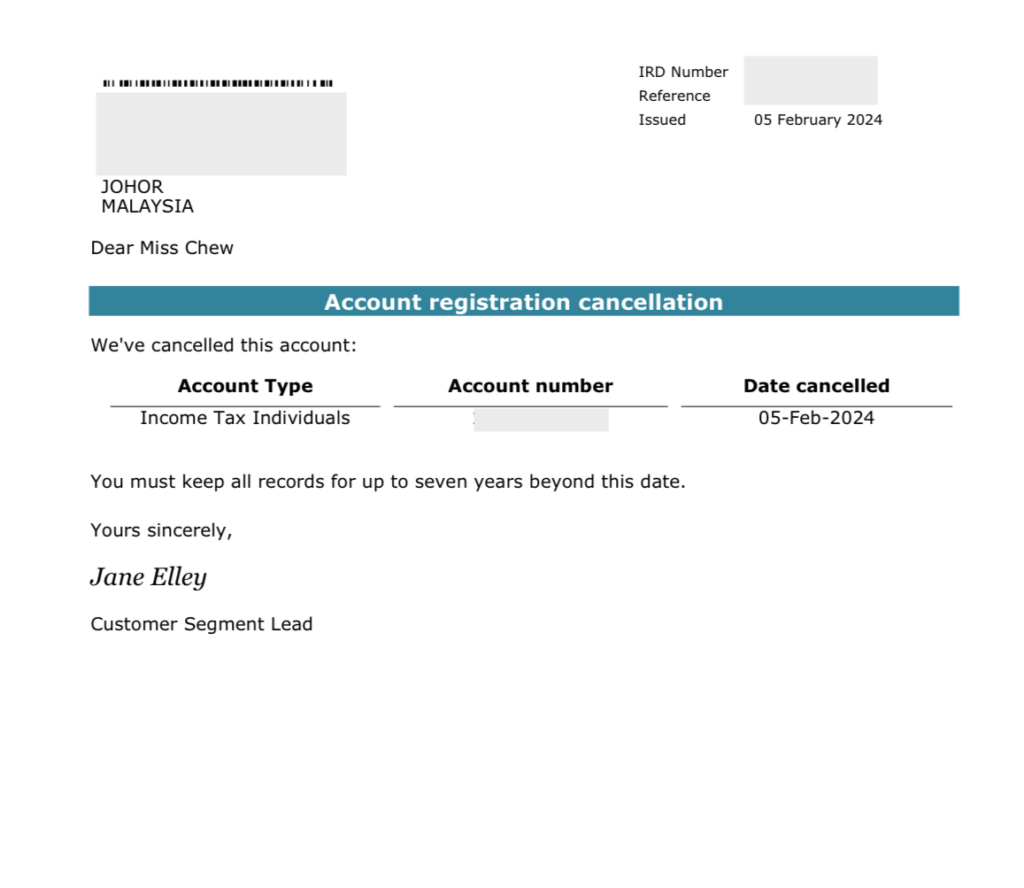

- The second letter is the notification of the cancellation of the IRD account.

I received the refund, and it was indeed completed within two days, very efficient.

You don't have to wait until April for the tax refund in New Zealand; you can apply for it immediately and get your money back. I hope this helps those in need!